Overseas Study

Do American students have a loan service?

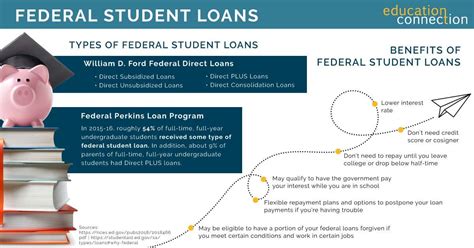

Today I'm going to talk about how American college students have access to loan services, and the text will start right away. Financial Aid Because this program is a fully financed loan credit credit, all enrolled students are effective for student loans. The first step in obtaining a loan is to complete the Free Application for Federal Standard Aid (FAFSA) at http://www.fafifsa.ed.

The FAFSA takes one to four weeks to process and you will then be sent a Student Aid Report (SAR). Once your application has been reviewed you will recall an Award Letter finding the loan Aounts you are equal for and necessary documents to re-establish the loan fund. To review schools available, please crowd the UCI Financial Aid site at http://www.fao.uci.edu/.

We also examine you to check with your agent for promotion projects and with your unit for promotion or examination. Federal Direct Masters are available to M.A.S. students.For special measures on monetary crime see www.fao.uci.edu/hbp02.php. Lots are available up to $18,500. Streets who demonstrate financial need may be effective for $8,500 of the $18,500 in subsidised local projects. See www.directloans.ed.

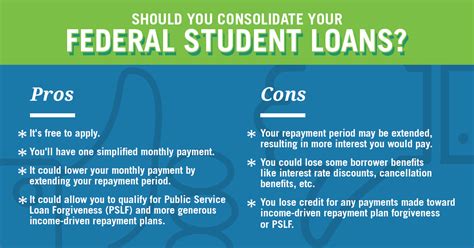

The Federal Direct Agent Loan program has two types of loans available. Subsidized loans - interest acrues on a borower #39; s loan while the Borrower is in school, Grace, or aboveed perods of treatment, and is paid by the government. Unsubsidized loans - the Borrower is Fully responsible for paying the least that charges on the loan.

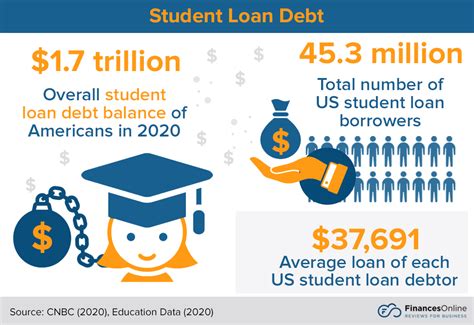

Interest on an unsubdirected loads from the date of disbursement and continues without the life of the loan. The Office of Financial Aid and Scholarships website (www.fao.uci.edu/hbtoc). For further information on how financial aid aid is available. It is possible to borrow both domestically and internationally, and whether Chinese banks can apply for loans to study in the United States for the vices of loans to study in the United States, and how many students choose to study in the United States.

An applicant for a loan is required to: (a) be 18 years of age or older, be a natural person with full civil capacity, the actual age at which the loan expires is not more than 55 years; (b) have a valid resident status in the country, with a fixed and detailed address; (c) have a letter of admission to an American school, and have proof of the amount of school fees required during the course of the school's studies; and (d) have an application for a loan that requires collateral.

Third-party guarantors need to provide an asset mortgage or a surrogate capacity and be jointly and severally liable; 5 or a loan applicant must be able to meet part of the total cost required to apply for another part of the loan; 6 or other terms of the loan imposed by the lender need to be fulfilled. 7 or the lender needs to have other supporting documentation and material at the time of the application. 8 or the tuition fees available for United States study abroad are subject to a certain limit and cannot exceed 80 per cent of the total amount required for miscellaneous expenses.

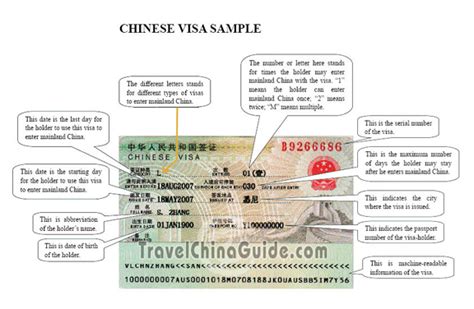

Note 1: When applying for a loan for a loan to go abroad, the applicant must clearly instruct that the loan should be used for such a loan.2 The loan contract requires the preparation of an English version of a loan to which many banks are currently providing a loan, but not all banks are able to provide an English version of the loan. This is also what clients need to be aware of when applying for a loan to go abroad. If there is no English version, there may be a problem at the time of the visa.

The bank, by checking its credit records, will know the integrity of the lender, which is important in studying abroad. How the US can apply for a loan first: to choose your nationality and the school you are going to attend in the Student Loans option. Second, please press “Compare StudentLoans.” Third, the Student Loan Tool will help you to find out which appropriate lending institutions are available, look at the terms and by-laws of each loan, and then choose the institutions that best suit you.

Fourth: When you have a clear idea of the loan items to be selected, you start the application online by “ApplyNow.” You can easily apply for student loans as soon as you follow these steps. You can get initial approval within a few weeks. Remember, student loans require repayment of your interest. Before applying for a loan, consider clearly whether there are other financial assistance options or improvements to your own scholarship programmes.

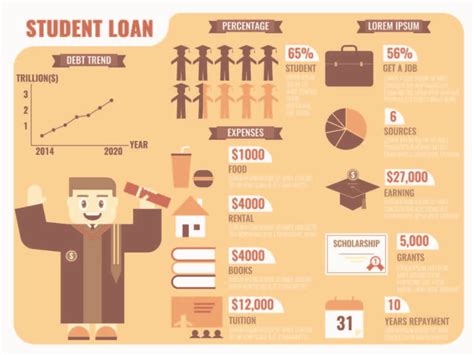

If the interest rate of the loan is more than one year, the interest rate of the loan will be adjusted and the contract rate will remain unchanged. If the loan is adjusted for a period of more than one year, the interest rate will be charged at the interest rate adjusted by the bank. (A loan will expire within one year, a one-time debt service will be paid for more than one year and a half-year debt will be repaid.) The maximum amount of the loan limit for the loan will not, in principle, exceed 80% of the total tuition fee.

In the case of loans with a duration of less than one year (including one year), the principal interest of the loan is liquidated once the loan is due, and the principal interest of the loan is more than one year (excluding one year), and the principal interest of the loan is repaid on a monthly equal basis. On the assumption of a loan of 500,000 dollars, the duration of the loan is two years, and the actual interest will have to be repaid at about $8,000 per quarter, plus a total of approximately $68,000.

In addition, there are individual banks, which may develop different methods of repayment for diffe rent families, depending on the family situation of the student applying for a loan. The specific payment is governed by the bank's rules. In addition, the bank will provide the borrower with a specific repayment schedule according to which the borrower can repay the loan on time. “This does not result in the creation of demurrage payments and the presence of a stain on the bank's black list as a result of the default.” The repayment of the loan on study and interest rate is calculated as follows: one or the equivalent, i.e., the total amount of interest paid on the loan for each period of the loan period is fixed.

rent families, depending on the family situation of the student applying for a loan. The specific payment is governed by the bank's rules. In addition, the bank will provide the borrower with a specific repayment schedule according to which the borrower can repay the loan on time. “This does not result in the creation of demurrage payments and the presence of a stain on the bank's black list as a result of the default.” The repayment of the loan on study and interest rate is calculated as follows: one or the equivalent, i.e., the total amount of interest paid on the loan for each period of the loan period is fixed.

2. The principal is equal to the principal to be repaid in each instalment, and interest is calculated as interest on the balance of the current loan. Third, and second, the annual debt service is increased by a percentage from the debt service of the previous year. Fourth, and second, the annual debt service is reduced by a percentage from the debt service of the previous year.

The interest rate of the Sino-China Business Bank’s loans is applied in accordance with the loan interest rates and floating margins announced by the People’s Bank of China. When the People’s Bank of China adjusts the interest rate of the loans, the interest rate of the loans that have been issued for study abroad starts with a new interest rate from the next repayment period of the People’s Bank’s adjustment of the interest rate of the loans.

The types of collateral guaranteed by the Sichuan branch of the Bank of China include: real-estate mortgages - the mortgage rate must not exceed 60 per cent of the assessed value; deposit orders, state debt pledges - the opening bank of the bank must be the Beijing branch of the Bank of China and the bond rate must not exceed 90 per cent; third-party joint liability guarantees - the borrower and guarantor should have a permanent household in the city of Beijing, the guarantor should be limited to the parents of the borrower, should not exceed 60 years of age, and the repayment of the guarantee must not exceed 50 per cent of the monthly income, as evidenced by a personal income tax payment certificate of not less than three months.

In the case of pledge guarantees, the following conditions should be met: the maturity date of the goods or the final maturity date of their transfer is later than the expiration date of the loan, and the maturity date of the loan may be dealt with in a different way. The mortgage provides that the mortgage is a mortgageable and mortgageable home owned by the borrower or a third person (natural person).

The Commercial Education Assistance Loans show that a loan for commercial education is a renminbi-backed loan granted by a lender to a borrower to attend a country’s primary, secondary, general higher education, master’s or doctor’s degree, or has been approved to attend a secondary school, university, and master’s or doctor’s degree abroad.

1. It is essential for the person to apply for a commercial student loan as a borrower to: (i) have complete civil capacity; (ii) have a valid residence card and must have a personal or pass to attend a school abroad; (iii) have an admission to a school (receipt letter) or a student's certificate and materials for miscellaneous and living expenses for the duration of the school's studies; and (iv) meet the standards of study and conduct requested by the lender.

Credible action; v. promise to inform the lender of the latest work unit and effective means of communication following his departure from school in a timely manner; vi. already having the necessary proportion of the education costs required of the person receiving the education; vii. consent to not repay the loan for a year after the loan, the lender may disclose his/her default in his/her attendance at the school or in the relevant media; viii. pledge of assets recognized by the lender, or guarantee of joint liability by a third party; ix. other loan prerequisites prescribed by the lender.

Direct family members and legal guardians of an educated person who apply for a commercial loan as a borrower must meet the following prerequisites: first, full civil capacity; second, local residence status and a detailed, fixed address; third, a decent and uninterrupted source of income, good reputation and ability to repay the loan; and fourth, an admission letter or a takeover letter for the educated person to attend a school.

There is proof of the school fees and living expenses required during the period of school attendance; fifth, the granting of assets recognized by the lenders, pledges or guarantees of joint and several liability by third parties; sixth, the education provider already has the necessary percentage of the cost of education; seventh, the conditions for other loans prescribed by the lenders; and second, the duration of the loan is normally between one and six years, up to a maximum of 10 years (including 10 years); and third, the interest rate of the loan rate of the commercial student loan fulfils the interest rate established by the People's Bank of China for the loan of the same kind in the renminbi.

In principle, the amount of the loan limit for commercial student loans must not exceed 80% of the school fees and living expenses required for the duration of the student’s schooling.5 If the loan is repaid for a period of one year (including one year), the principal interest may be repaid on a monthly basis or at a maturity; if the loan is extended for a period of more than one year, the principal interest of the loan shall be repaid on a monthly basis, and the repayment of the loan shall be made once in each school year on the basis of the number of loans granted in the year in question.

The loan applicant is in favour of allowing some or all of the borrowers to make early repayments. 6. The loan application (1) is for the person to provide, as the client of the loan, the following information: (i) the original and copy of the person's valid residence identification document; (ii) the admission letter and copy of the student's certificate and copy of the student's certificate and copy of the student's certificate; (iii) the certificate of school fees and living expenses required during the course of the student's studies; (iv) the personal savings or credit card account opened at a Chinese bank; (v) the certificate of attendance at the school and the other documents and information requested by the Chinese bank in support of his or her entitlement to 50 per cent interest on the State loan; and (vi) the other supporting documents and information requested by the Bank of China.

(2) The immediate family of the educated person or legal guardian, as the client of the loan, shall provide the following information: (i) the original and copy of the identity card, household book or other valid residence permit of the individual and spouse; (ii) the written certificate of the borrower and of the educated person authorized by the Bank of China; (iii) the certificate of admission to school and the proof of the fees and living expenses required during the course of study; and (iv) the promise or declaration signed in favour of the document, the object and the person entitled to the penalty, including the community of property.

In the event of a third-party guarantee, the guarantor shall produce a written document in favour of the guarantee, supporting the letter of credit; fifth, a personal savings or credit card account opened in a Chinese bank; sixth, other supporting documents and materials requested by a Chinese bank.

Borrowers of the same subject are those who attend primary, secondary, general higher education and master's or doctoral degrees in the country, or who have been approved to attend secondary schools, universities and master's or doctor's degrees abroad, or who are their legal guardians. What processes and conditions are required to apply for a U.S. study loan, which is not very good for many students who want to apply for an U.S. study loan, and what processes and conditions are required to apply for an U.S. study loan? Let me show you something.

First, the process for applying for a United States study loan; first, the process for applying for a United States study loan; the choice of your nationality and the school you are going to attend in the student study loan facility option; secondly, the choice of the lending institution that is best suited to you under the student study loan facility; and, fourthly, the online application process under “ApplyNow” when the loan is selected. If you follow the above, you can easily apply for a student loan.

Before applying for a loan, please know if there are any other scholarship projects. (b) The conditions for applying for a United States study loan; the integrity of a person's physical health without unlawful conduct;2 the actual age of full civil capacity at the maturity date of the loan must not exceed 55 years;3 the permanent household or other valid residence status of the person in whose place the loan is made;4 the permanent household or other valid residence status of the person's immediate family or spouse, and the stable source of work and income, and the ability to repay the loan;5 and the lender's need to provide evidence of the attendance letter or receipt letter, as well as the cost of living expenses for the school's tuition period.

6. The borrower is also required to provide an asset set-off, pledge or a third-party borrower with the capacity to pay and joint and several liabilities recognized by the lender, and the borrower already has a certain percentage of the costs required for the person to be educated. Mortgage property is currently limited to real estate pledges that may create mortgage rights, which are currently limited to state bonds, certificates of deposit, corporate bonds, etc., and which the guarantor of securities should be a legal or natural person with surcharge capacity and willing to assume joint repayment liability; 7; other conditions required by the lender; 3; the amount of the United States study loan applied for in the United States for a stay-of-school loan does not exceed the total sum of the renminbi equivalent of the school admission notice or other valid admission certificate, tuition fees for one year, living expenses and other necessary expenses.

Good specializations at prestigious universities in the United States,1 Princeton University,1 leading specializations: Mathematics and Philosophy, and History, English, and Political and Economics.2 Harvard University, leading specializations: History, Business Administration, Mathematics, Economics, English Language, Physics, Psychology, Sociology, Physiology, Political Sc ience, Biochemistry, Chemistry, Earth Sciences, etc..3 Yale University, leading specializations: the most focused subjects are social sciences, humanities and life sciences, and the three most popular are biology, history and economics.

ience, Biochemistry, Chemistry, Earth Sciences, etc..3 Yale University, leading specializations: the most focused subjects are social sciences, humanities and life sciences, and the three most popular are biology, history and economics.

4 At Annaburg, University of Michigan, specializations: business, engineering, medicine, nursing, law, public affairs, psychology, sociology and history.5 New York University specializations: accounting, finance, international trade, chemistry, mathematics, biology, education, health, law, medicine, communications, public services, art, film, television, theatre, music and performing arts.6 University of Rochester specializations: English, music, history, political science, psychology, mathematics and optical sciences.

7 Johns Hopkins University Strengths: The Faculty of Medicine and Harvard School of Medicine are known and the School of Public Health ranks first in the United States on a yearly basis. Postgraduate specializations in biology, biomedical science, biomedical engineering, electronic engineering, environmental engineering, human development, family research, health sciences, humanities, physics, mathematics science, international affairs, etc. are all ranked tenth in the United States. 8; E-engineering, mechanical engineering, physics, chemistry, economics, philosophy, politics. 9; Physics, engineering, chemistry, biology, astronomy, geology, economics and politics at Stanford University.

10. Columbia University’s leading specializations: architecture, ba, finance, art history, astronomy, bioscience, chemistry, computer science, mathematics, physics, geology, psychology, sociology, philosophy, politics, religion, film, history, economics, English, French, Spanish, and East and Central Asian language and literature departments. Preparations for the United States to study abroad: 1. Back up relevant important documents and prepare important entry documents for departure.

Note that if you have a report card, you must bring the original. If you can use a copy of your own bill of payment, whether for tuition or accommodation, you must bring copies of the money order and receipts. These other important documents, such as passports, are prepared before you leave, so that you can avoid losing yourself, or there are particular circumstances that require information to be checked. These are also notes and memos, and important numbers are recorded on the memo.

Some students may think that everyone has a cell phone, and there is no need to keep it in mind, but if the cell phone is lost, it will be very difficult when the phone number is needed. Prepare 2: Since the international tour is going to another country, it is important to open up your mobile card before leaving the country, so that you can contact your family immediately upon arrival in the United States.

Of course, in order to save money, students often need to communicate with their families and friends in the country, and it must be a lot of money at the international long distance every day, so it would be easy and cost-effective to use video communications to reach their families. Preparing for clothing here in the US usually goes to winter, except in the West Bank, where it snows, and where it usually snows.

Of course, those who read in the southwest do not have to wear these clothes, and there is usually heat in the rooms in winter, and too thick clothes are not necessarily needed. Preparation 4: A sense of safety in the US is generally safe, but this is not entirely safe.

First, step one: select your nationality and the school you are going to attend in the Student Loan Tool option. Second, press “Compare StudentLoans.” Third: The Student Loan Tool will help you identify the appropriate lending institutions, look at the terms and by-laws of each loan, and then choose the institution that best suits you. Fourth, when you know which loan item you want to select, use the ApplyNow to start the online application process.

and there is usually heat in the rooms in winter, and too thick clothes are not necessarily needed. Preparation 4: A sense of safety in the US is generally safe, but this is not entirely safe.

First, step one: select your nationality and the school you are going to attend in the Student Loan Tool option. Second, press “Compare StudentLoans.” Third: The Student Loan Tool will help you identify the appropriate lending institutions, look at the terms and by-laws of each loan, and then choose the institution that best suits you. Fourth, when you know which loan item you want to select, use the ApplyNow to start the online application process.

If you follow these steps, you can easily apply for student loans. The quickest you can get initial approval in a few weeks. 2. A loan applicant is required to provide a letter of acceptance or a letter of acceptance for school attendance, proof of the cost of living for school fees required during the school's term of attendance, as well as an asset credit, a pledge or a third-party borrower with a surrogate capacity and joint liability, and the borrower has a percentage of the costs required for an educated person. (3) The amount of a loan application and a loan for a year's study abroad does not exceed the sum of the registration fees, tuition fees, living expenses and other necessary expenses specified in the letter of admission to a school or other valid admission certificate.

How to get a U.S. study loan for people who do not have enough economic power, but who have a U.S. dream of studying abroad, can realize this dream by doing so. Would you like to know what the conditions are for obtaining an U.S. study loan application and some other information? Look at me. 1. What are the conditions for an U.S. study loan application? If you want to apply for a study loan, you must meet the following conditions: if you are a borrower, you must have full civil capacity, and the loan cannot last longer than your actual age, 55 years of age.

If you are a borrower, you must provide information about a relative and, if you are married, about the spouse, ensuring that you have a stable source of employment and income and the ability to repay the loan. 2. What is a loan for study abroad? A loan for study abroad is one of China’s educational loan operations. According to the Bank of China, “an education loan is a consumer loan granted by a lender to a borrower for his own or his legal guardian to attend a country’s secondary school, general high school, master’s degree, doctor’s degree, etc., or has been approved for study abroad for secondary school, university, master’s degree, doctor’s degree, etc.

The Education Assistance Loan is based on the principle of “effective guar antee, repayment on time”, according to which both parties enter into a loan contract in accordance with the law.

3. What are the conditions for the application? (1) a Chinese citizen with full civil capacity; (2) a permanent household or a valid resident status with a fixed and detailed place of residence; (3) a letter of acceptance or a letter of receipt for school attendance; supporting material for school fees required during the school's term of study; (4) a third-party guarantor of assets recognized by the lender, pledged or with a surcharge capacity and joint and several liability; (5) the borrower has a certain percentage of the costs required for an educated person; (6) the fulfilment of other loan conditions prescribed by the lender.

antee, repayment on time”, according to which both parties enter into a loan contract in accordance with the law.

3. What are the conditions for the application? (1) a Chinese citizen with full civil capacity; (2) a permanent household or a valid resident status with a fixed and detailed place of residence; (3) a letter of acceptance or a letter of receipt for school attendance; supporting material for school fees required during the school's term of study; (4) a third-party guarantor of assets recognized by the lender, pledged or with a surcharge capacity and joint and several liability; (5) the borrower has a certain percentage of the costs required for an educated person; (6) the fulfilment of other loan conditions prescribed by the lender.

This post is part of our special coverage Egypt Protests 2011. How should a United States study loan be applied for? The borrower should submit a written request for a loan to the lender (meaning the domestic branch of the Bank of China) and complete the application form and submit the following documents, certificates and information: (1) the original of the personal and spouse's identity card, marriage certificate, family account or other valid residence permit, the valid identity certificate of the educated person, the original passport of the educated person, the original visa and a copy of the copy of the certificate of guardianship and the birth certificate of the educated person, which is not certified by the State notary department; and (3) the letter of admission to the school.

In the case of a mortgage, a pledge list and a promise or a declaration of consent to a mortgage or pledge signed by the right to dispose (including the joint owner) are to be submitted to a value assessment report issued by the relevant authority and insurance documents issued by the insurance department, and proof of authority is to be provided for the pledge.

A third-party guarantee shall be accompanied by a written document in which the guarantor consents to the guarantee, supporting the letter of credit; (5) the original deposit of personal savings and a copy or credit card opened at the loan bank; (6) other supporting documents and materials required by the lender; (5) the duration of the United States study loan? The duration of the loan shall normally be one to six years, up to a maximum of 10 years (including 10 years), depending on the borrower's attendance and the nature of the guarantee.

The duration of the loan is less than one year (including one year) and the interest rate of the loan remains unchanged in the event of an adjustm ent to the statutory rate of interest; the duration of the loan is more than one year and, in the event of an adjustment to the statutory rate of interest, the interest rate is adjusted in accordance with the provisions of the People’s Bank on the adjustment of the interest rate. (Note: one loan is due within one year for the repayment of interest and one half-year loan for the repayment of interest and interest.)

ent to the statutory rate of interest; the duration of the loan is more than one year and, in the event of an adjustment to the statutory rate of interest, the interest rate is adjusted in accordance with the provisions of the People’s Bank on the adjustment of the interest rate. (Note: one loan is due within one year for the repayment of interest and one half-year loan for the repayment of interest and interest.)

At present, the Bank of China is not in a position to provide foreign-exchange loans to borrowers who have gone abroad. Therefore, the exchange of remittances for students who have gone abroad is subject to an application for transfer in accordance with the relevant regulations of the Foreign Exchange Authority, and the exchange of tuition fees and living expenses in Chinese banks for each academic year.

8. The size and length of the United States loan for study abroad? The amount of the loan for study abroad does not exceed the registration fee specified in the school admission letter or other valid admission certificate, the sum of the equivalent of tuition fees, living expenses and other necessary expenses for one year, up to a maximum of 500,000 yuan and up to a maximum of six years (inclusive of six years). 9. What are the types of guaranteed mortgages for the United States loan for study abroad? (1) Real estate mortgages: the maximum amount of the loan does not exceed 60 per cent of the value of the collateral recognized by the lender; (2) pledge (state debt, principal mortgage): the maximum amount of the loan does not exceed 80 per cent of the value of the pledge.

(3) Credit guarantee: If the guarantor provides a guarantee of joint and several liability by a third party, the guarantor may grant it in full, if the guarantor is a legal person recognized by the bank; in the case of a natural person recognized by the bank, the maximum amount of the loan does not exceed RMB 200,000. Why are United States university students used to pay their tuition fees? First, the United States supports student loans, a policy that supports poor people to change their destiny by learning. Second, the Americans are more open and confident, which affects their living environment.

If you want to know more about the loan services available to American university students, please pay attention to the collection site.

-

Previous

Difference between Chinese and United States passports

This article tells you that the difference between the Chinese passport and the difference between the United States passport, in the hope that it will help you, is starting to be explained. The di

-

Next

America's hardworking to learn how to apply.

This article gives you an idea of how U.S. E.L.A. can apply for the corresponding knowledge points, hoping that it will help you not forget the collection site. The U.S. R.A.A. application process,

Related articles

- What good universities are there in Egypt?

- Are there any good universities in Canada?

- A comparison between Cambridge University and Harvard University

- What universities are there in the UAE studying in Wolong, Dubai

- How about the University of Salford? the plane flew to Manchester

- Chemical synthesis of diamonds how diamonds are formed

- How much does it cost to study in Portugal for a year

- Beijing University employment rate

- How much does it cost to study in Uzbekistan for a year the cost is basically the same

- What universities are there in Tanzania